Speaking Engagement

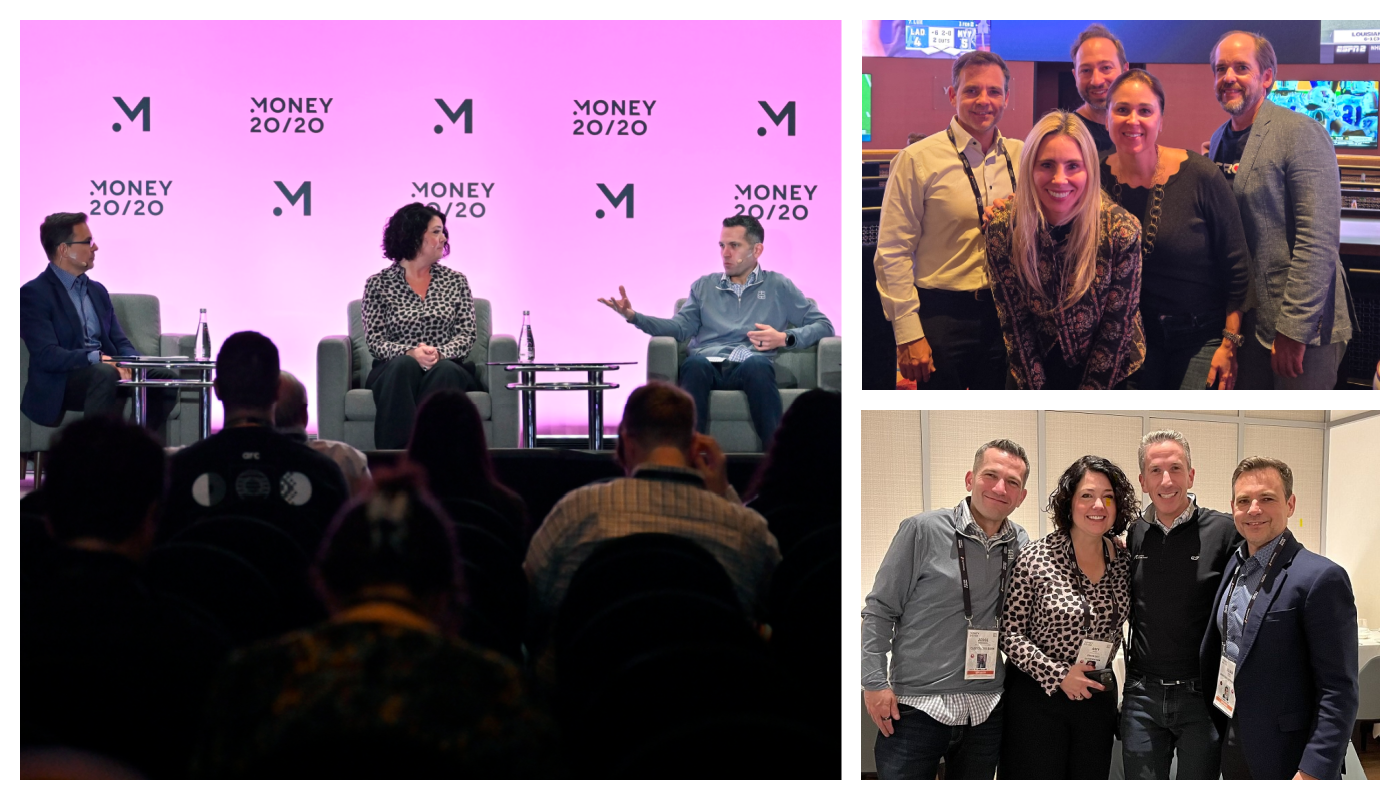

Juan Azel Moderates Panel at Money 20/20 USA

Speaking Engagement

October 27, 2024 - October 30, 2024

Partner Juan Azel moderated the panel “Judgment Day: Balancing the Benefits of AI with Regulatory Risks” at Money 20/20 in Las Vegas. The panelists included Jesse Honigberg, EVP of products & platforms from Customers Bank, and Amy Pugh, general counsel from Green Dot Corporation. The discussion focused on the arrival of AI and its application in fraud detection, customer service, and credit risk assessments within banks and financial institutions.

The panel addressed the latest regulatory developments and highlighted the importance of a comprehensive strategy for AI adoption. This includes addressing biases, ensuring data privacy, complying with regulations, and maintaining transparency to mitigate the risks of civil or regulatory actions.

Key Takeaways

- AI Adoption: Systematic implementation of AI technologies is essential.

- Opportunities:

- Demystifying AI: Clarifying types and applications.

- Risk Mitigation: Enhancing risk management through AI.

- Stakeholder Comfort: Understanding comfort levels is crucial for implementation.

- Increased Awareness: Recent awareness has made AI more relevant in banking.

- Supportive Tool: AI should enhance human decision-making by filtering valuable information.

- Model Validation: Essential for reliability and effectiveness.

- Evolving Strategies: Ongoing discussions on managing risks associated with AI adoption in a changing regulatory landscape.

Phil Goldfeder, CEO of the American Fintech Council, was also in attendance, as well as Winston attorneys Carl Fornaris, Monica Lopez-Rodriguez, and Daniel Stabile, who represented our FinTech & Payments and Cryptocurrencies, Digital Assets & Blockchain Industry Groups.