Client Alert

Transatlantic M&A: What Buyers Should Expect

Client Alert

July 16, 2025

US–UK private M&A activity in 2025 is experiencing a notable resurgence, driven by improved macroeconomic stability, available capital, and sector-specific opportunities.

Introduction

Although 2025 has so far witnessed significant market turbulence, looking ahead into the second half of the year, many factors appear promising: markets have begun to price-in the impact of tariffs, corporates have historically strong cash positions and private equity buyers are under increasing investor pressure to deploy dry powder.

What should a buyer from the US expect when it crosses the Atlantic to purchase a business in the UK, and vice versa? This briefing will explore some significant differences in market deal terms that transatlantic buyers should be prepared to consider when seeking to buy the stock of a private company in its respective counterpart.

Purchase Price Adjustments

Typically, in US private stock deals, the buyer buys the target on a “cash-free, debt-free” basis, which may be subject to purchase price adjustments post-closing. Although closing accounts mechanisms remain common in the UK, a “locked box” purchase price approach is increasingly prevalent, under which historic accounts are used to calculate a price which the buyer will have no ability to adjust after closing. The buyer will then rely on contractual protection to ensure that no material cash or assets are “leaked” out and no material liabilities are intentionally incurred in the interim period. See the Winston & Strawn briefing, The Locked Box Mechanism, for further details.

Bring Down of the Warranties; No Material Adverse Change

In both the UK and the US, it is not uncommon for warranties to be repeated or “brought down” at closing. However, sellers in the UK will seek to resist that principle if there is any gap between signing and closing. In addition, unlike in the US, it remains unusual in the UK for the accuracy of all warranties at closing to be a condition of closing, or for there to be a “no material adverse change” closing condition.

Warranty Insurance Cover

Warranty and indemnity (W&I) cover is increasingly prevalent in the UK, as is its equivalent, representations and warranties insurance (RWI), in the US. A UK-style policy tends to be narrower and typically includes more exclusions. UK W&I insurers will usually require a full legal due diligence report and will walk through each warranty individually to determine what coverage can be provided. While the base premium is generally much lower than that of a US-style policy, buyers will be offered the option to purchase additional coverage enhancements for an extra premium.

In contrast, a US-style policy is typically broader and includes many of these enhancements as standard — with a correspondingly higher premium. Where preferred, US buyers can acquire US-style policies for acquisitions of UK businesses.

Indemnification

A key difference between US and UK deals relates to indemnification for breaches of representation and warranties. Damages for breach of warranty in a US deal are usually calculated on an indemnity basis against the full amount required to rectify the defect. By contrast, most UK deals do not usually calculate damages on an indemnity basis, other than for specifically agreed circumstances. The buyer is therefore required to prove that it has suffered a quantifiable loss. In UK deals, indemnities are typically limited, if any are included at all, to known liabilities, such as environmental liabilities, tax concerns or underfunded pensions.

Disclosure

Typical US market practice is for disclosures against warranties to be specific, warranty-linked and set out in detailed disclosure schedules to the agreement. A UK sale agreement will normally allow the seller to submit a disclosure letter containing both general and specific disclosures. Although potentially risky for the buyer, the seller will sometimes also be permitted to make a general disclosure of the contents of the entire data room of due diligence documents, tempered by the concept of “fair disclosure”, where a document in the data room will only qualify a warranty where it contains sufficient information to allow the buyer to make reasonably informed assessment of the circumstances.

Tax

In the US, tax liabilities and benefits are typically split between pre-closing tax liabilities and benefits, which are the sole responsibility or benefit of the seller, and post-closing tax liabilities and benefits, which are the responsibility or benefit of the buyer, subject to a “straddle period” between the last fiscal year end and the closing date. In the UK, tax liabilities and benefits typically “go” with the target—and therefore the buyer—unless the seller wants to try to retain group reliefs/the benefit of tax allowances. This fact is usually factored into the purchase price. As a result, a buyer would typically only obtain a specific pre-closing tax indemnity document in relation to tax which is out of the ordinary course of business, unknown or not provided for in the financial statements.

Unlike in the US, UK stock deals will typically be subject to stamp duty.

Restrictive Covenants

A US stock deal will generally have restrictive covenants, such as non-competition, non-solicitation and no-hire covenants, customarily lasting from one to five years (and sometimes even longer). UK purchase agreements will typically contain these types of restrictive covenants but with a shorter time period. Three years is generally considered to be the maximum period that a UK court is likely to accept (and it would not be unusual for shorter periods to be agreed between the parties under the purchase contract), but each situation will be treated differently as there is no definitive time period provided in English law.

Conclusion

The UK remains an attractive destination for US buyers, while the US affords exceptional opportunities to ambitious UK buyers. Although UK and US practice is aligned on some issues, significant differences do remain. With UK practice tending to result in more favourable contractual terms for a seller than a buyer in comparison with US practice, understanding the differences from the outset of a deal will inevitably assist a buyer to not only minimize risk but also act in a way that can be seen as being consistent with the local deal environment.

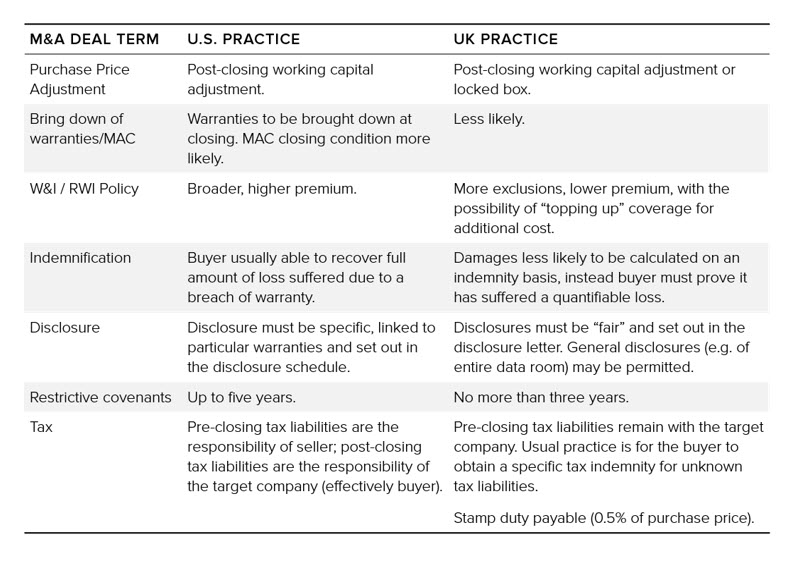

Summary of Key Differences