Blog

Long-Term Part-Time Employee Retirement Plan Rules In Effect as of January 1, 2024

Blog

June 18, 2025

Background

With the passage of the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act) and the subsequent SECURE 2.0 Act (SECURE 2.0) in 2022, the last few years have been a time of upheaval, confusion, and ongoing disruption within the retirement plan space. This summary focuses specifically on the new long-term part-time (LTPT) employee eligibility requirements as modified by SECURE 2.0 that became effective January 1, 2024.

Prior to the SECURE Act: A retirement plan sponsor could not require a period of service greater than the later of age 21 or a 12-month period in which the employee provided at least 1,000 hours of service (unless the plan had 100% vesting, in which case the sponsor could require two years) for participation in a retirement plan.[1] This meant that many part-time employees would never become eligible to participate based on the 1,000 hours of service requirement.

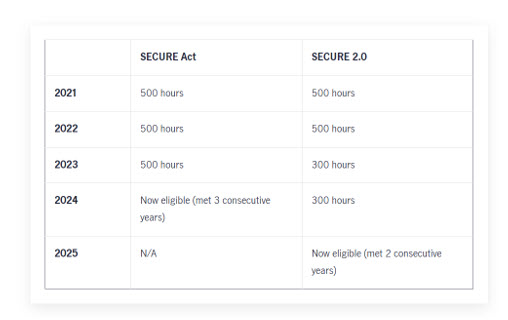

SECURE Act: Starting with plan years beginning after December 31, 2020, retirement plan sponsors were required to permit employees with three consecutive 12-month periods during which they complete at least 500 hours of service (and who meet other eligibility requirements) to be eligible to participate in 401(k) plans.[2] Retirement plan sponsors were allowed to disregard hours of service completed in plan years before January 1, 2021.

SECURE 2.0: For plan years beginning on or after December 31, 2024, retirement plan sponsors may permit employees with only two consecutive years during which they complete at least 500 hours of service (and who meet other eligibility requirements) to be eligible to participate.

Example of Change in Eligibility Guidance[3]

What this means for you:

As a retirement plan sponsor, the seemingly continuous changes in retirement plan guidelines add complexity to your administrative burden.

Considerations for treatment of part-time employees: Do you still want to continue to treat part-time employees differently from full-time employees from a retirement plan participation perspective?

For example, to ease your administrative burden you may:

- Eliminate any hour requirement for eligibility purposes, or

- Require no more than 500 hours in a 12-month computation period.

- To avoid additional costs, you can impose a different (but still compliant) service requirement to receive employer contributions for all employees, or applicable only to part-time, temporary, or seasonal employees.[4]

Steps to ensure compliance:

- Coordinate with internal key stakeholders on your treatment of part-time/temporary/seasonal employees as compared to full-time employees.

- Liaise with your ERISA counsel to understand the implications of the current legislation.

- Engage your retirement plan vendors to ensure that their processes are in line with legislation and your company’s prerogatives.

- Calculate any additional costs or expenses from related legislation to ensure budget accuracy.

- Update and distribute employee communications and plan documents as necessary.

This blog post was co-authored with David Neikrug and Sarah Shtutin from Optimatum; learn more about their services here.

[1] https://www.bloomberglaw.com/external/document/X84JDJVC000000/retirement-benefits-professional-perspective-secure-2-0-long-ter

[2] https://www.bloomberglaw.com/external/document/X84JDJVC000000/retirement-benefits-professional-perspective-secure-2-0-long-ter

[3] https://retirement.johnhancock.com/us/en/viewpoints/legislative--regulatory/what-are-the-long-term-part-time-rules-under-secure-and-secure--#:~:text=SECURE%202.0%20further%20modified%20the,to%20the%20two%2Dyear%20rule.

[4] https://retirement.johnhancock.com/us/en/viewpoints/legislative--regulatory/what-are-the-long-term-part-time-rules-under-secure-and-secure--#:~:text=SECURE%202.0%20further%20modified%20the,to%20the%20two%2Dyear%20rule.

This entry has been created for information and planning purposes. It is not intended to be, nor should it be substituted for, legal advice, which turns on specific facts.